Talk:The financial system

The introduction and use of currency raises some critical issues. I bring this up not to distract from the project, but to develop in tandem with the project to keep it aligned to her values. I am not an SME in this area other than to be a consumer and investor. However, I have invested (pun intended) significant thought into currency and my thoughts are now able to be played out in the public arena for synthesis.

Contents

Identity

- The traditional currency model is based on Trust in a Central Authority. What makes currency in the project different?

- The system must be secure and trusted for people to use it. No person can have access to private accounts.

- What do we call the "currency" to differentiate it from "dirty money." (Why/How to define dirty money?)

- There's no need to have a single global name for it, people can change names of any concepts in the network including that for currency.

- Is it possible to have currency without a bank?

- What are you defining a bank as? there's no physical location of currency in the network, but there must be a trusted secure way of storing account balances. The nodal organisation which handles that could be called a bank, but again that name is up to individual preference.

- "Who" issues currency? / "Who" loads the initial currency value? It seems to me that there would be a finite set of currency issued (like stock) that could split, but no more could be created? Or, is this an infinite resource (back to Who creates it?)

- Currency is not money, it is simply a representation of the value of already existing resource. The total amount of currency expands or contracts as the total amount of resource expands or contracts.

Potential problems

- Is it possible to have anonymous transactions in the nodal context? Or will identity always be attached?

- Any context can have security, and transactions may occur inside any context.

- what about non-associated avatars?

- Avatars may be human or nodal, and may be anonymous or not, all can make transactions if both parties are happy to deal with each other etc

- Since currency could/would have "stigma" attached to it (the history of every transaction that will be inherent), it would measure public (and private?) behavior/economics, as well as serve as a public record of morality.

- Since currency will follow the nodal model, it would seem that certain "dollars" could/would attain intrinsic value. For example, "dollars" that are used to purchase goods or services that are "rare" or had historical significance would have greater value than those that were more "common." These "dollars" could be sold or traded in a way that duplicates interest, or "hoarded" (removed from circulation) in a way that would reduce supply and increase demand for circulating currency.

- All currency is the same, its just a number in an account and cannot undergo change unless there is a change in the resource of the account holder.

- Does the currency value fluctuate (inflation/deflation)? if the currency issued is finite/fixed, then it seems that "inflation/deflation" would be synchronized 1:1 with supply/demand.

- There is no inflation/deflation, but the value of resources change throughout places and times.

- Advantages:

- Disadvantages:

- Issues with a CA if we have one.

- Advantages:

- Disadvantages:

- Open or closed (Exchange Rates)?

- Advantages:

- Disadvantages:

Discussion with another p2p developer

I'm interested in learning more about your p2p currency idea, I may be interested in helping with some development, but would need to know more before I could make a decision on that - specifically I'm not interested in being involved in any p2p systems unless they are absolutely "bottom-up" architecture which is not controlled by a centralised organisation of any kind, otherwise it's vulnerable to legal attacks and also its members are at risk from it's own corruptability. I've studied p2p systems for a long time and have done a lot of research on p2p security methodologies and possible methods that a payment system could work by. Let me know if you're interested in discussing these ideas further. --Nad

- Thanks for your interest in our concept; what we believe could be the "holy grail" of financial transaction – micro-payments between peers without an intermediary.

- A few colleagues and I started believing exactly as you hypothesize - in order to succeed, this product must transcend legal and financial chains to any individual country or currency, with no "central bank" subject to government intervention (the PayPal model).

- But we've batted this idea around ad-infinitum and while we can create secure anonymous clients, use secure transactions between them, and successfully create credit/debit ledgers from which people can give or take, the problem comes when it’s time to “pay up”.

- This makes this concept different from a Gnutella or BitTorrent, where physical data can be dispersed without any central repository. With these peer models, if the item you want isn’t at a location, you can find alternates, OR you really haven’t lost anything. With money, if you go to collect, you can physically be out money. There simply needs to be the concept of an escrow agent, or a trusted third party. This brings us back to the PayPal model, which is already done...

- This project is currently it is in its theoretical stage – we’re trying to solve the stumbling block that you mention – making it truly agnostic. Building the client will be the *easy* part – developing the method whereby people use it either on an honor system, or via some sort of physical payment system, is the difficult part. Having had too many buddies “forget” to pay a debt to me, I don’t think the honor system will work when it comes to cash.

- At any rate, I'd definitely be interested in hearing if you have any thoughts on overcoming these obstacles. Obviously, the first step is developing a solid concept to develop a product plan from, then solicit developer support. --SC

- Hi Sean, thanks for your reply. I think you're right about the problem always coming down to the necessity of a trusted third party. But I believe that P2P networks have the potential to solve this problem because they have the concept of centralisation within them.

- For example, if we think about the network protocol that all the peers have in common - this is like a large global organisation which is responsible for storage and distribution. Another such global p2p organisation found in most networks is security - it is able to work more effectively than its client-server counterpart by working in the network protocol layer to maintain a repository of private shared context between peers which they can then use to encrypt their communications.

- So why should there not be a similar organisation for handling currency - a central bank organisation that works the same way as the storage & distribution and security "organisations"? I believe leveraging this holistic aspect of p2p networks and allowing complex organisation to be built upon it is the way forward - and I think such organisations would be more robust, secure and trustworthy than their top-down counterparts.

- As with your system, my ideas are still very theoretical, but this holistic aspect of p2p is the general direction that has manifested over the years and I'd be interested to hear what your thoughts are on it. --Nad

- Forgive me if I'm not following your train of thought here, but in your original email, you wrote that you'd only be interested in a paradigm "which is not controlled by a centralised organisation of any kind, otherwise it's vulnerable to legal attacks."

- In your email below, it appears you are now accepting the need for a centralized repository, wherein lies the exact problem. Once you accept a centralized repository (which is where we are stuck), you are vulnerable to government intervention (the centralized agent must reside somewhere in the world) and accountability. If we go this path, which is always possible, we are, as we've coined it, YAPP (Yet another PayPal). Then it becomes solely a marketing dollars game (to gain market share).

- There are pure peer-to-peer systems that don't require a centralized structure, such as Gnutella, where both directories and data is p2p rather than client-server. As I have previously stated, that concept is great when the item sought is perhaps a song, perhaps a video. It is not so great when the peer node who accumulated $500 worth of debt decides to shut down and leave everyone else holding his debt.

- So we're left with somebody who you trust, and who your friends trust, holding your cash and theirs, and keeping a ledger of who owes who money. This is the intermediary, the PayPal, the StormPay, the etc...

- That is where we're stuck - not in the theoretical, but in working out the "nuts and bolts" of how this would work.

- Any thoughts on a mechanical level would be greatly appreciated!!! --SC

- Sorry for the confusion I should have explained more clearly - it does sound like a complete contradiction! what I mean by "centralised" in this context is a very different idea than the classical top-down use of the word.

- I'm talking about a single organisational system responsible for securely handling the global "tree of accounts" (which could also be expanded to handle other forms of resource too such as stock items, storage space or processing resource). It is centralised in that it's one organisation used by all peers, but it's a "virtual organisation" which only exists inside the p2p network - it is not tied to or controllable by any real-world entities.

- I think this is actually the way that p2p is going to head of its own accord - I think its a natural consequence of moving grid/web3 technology (abstraction of resource and organisational systems) into p2p space. --Nad

- Please refer to Wikipedia:Peer-to-peer - You'll notice the discussion of how Napster and IRC use client/server for maintenance of directories. Gnutella does not.

- So when you discuss the central repository within the organization - you're really simply stating that it would be Gnutelly-like, where the directory (tree of accounts) is stored amongst the peers - self contained without a central entity like Napster or IRC. This self contained directory already exists in Gnutella (p2p doesn't need to "go that way" - it is already there).

- Now the trick is attaching something of true value to that environment. Sharing videos or mp3's is hugely different from sharing money. The difference is in the fact that mp3's are "nice to haves" - if you can get the song, great, if not, perhaps someone else may put it up eventually. If the node that had them is dead, you're not likely to get upset. Now, if that node that you just loaned $100 to was dead, you'd be pissed and never use the system again.

- So, how does that work? That is the million dollar question. --SC

- I'm familiar with that article and with the difference between gnutella/napster - but the "going that way" I refer to is specifically the application of higher level organisation formed from the distributed tree - ie the tree exhibits semantic meaning allowing it to be organisationally active, rather than just a dead structure of static content.

- Also such tree's which are built on DHT and KBR technology can be designed in a very secure and robust way such that it would takes a large portion of failing nodes for any parts of the tree to become inaccessible. The tree is a logical network layer which sits above the dynamic unreliable peers in the same way that a secure and reliable TCP/IP socket can sit upon an unreliable noisy network connection exhibiting many failing packets. --Nad

- I've sent you some papers you might find useful in your research, these are some of the other projects I've found which are working along similar lines of creating stable decentralised applicational/organisational environments within networks formed from unreliable intermittent peers.

- What this kind of technology would be able to give us is basically a unified object tree of global network scale - not just a filesystem, but an actual decentralised runtime environment within which we could build applications and organisations.

- At the risk of sounding obsessive and becoming irritating I'd like to attempt an explanation of what I'm on about one more time....?

- One of these decentralised applications mentioned above could be the "bank organisation" which maintains all account information and transactions amongst users and organisations within the network. No one has "sysop access" or the power to manipulate content they don't have permission to access, or the ability to close the bank down etc.

- This could all work perfectly if we imagine initially that all trade were completely independent of external currency. People could buy and sell goods and services through applications running in the network and then on completion the network bank application updates the appropriate accounts. (this is all decentralised, the application execution and storage of accounts is distributed across many peers, its all just encrypted fragments from the perspective of any prying eyes within in any peers)

- The difficulty arises when we want the purchasing power that comes with having access to an account in the network to be exchangeable with other currencies outside the network. But in this network, the exchange problem is very different than the one you talked about because it no longer involves individual users having to trust one another directly, it's always between the network's "bank" and an outside bank. It would come down to whether or not people could trust the network bank application to always be capable of "paying up" not ever whether another person can. In other words, we're creating the necessary centralised "trusted third party" inside the p2p context.

- I don't know if that clarifies the idea better, but thanks for listening anyway, it helps me to organise my own notes by trying to explain it more clearly. --Nad

- [So where does the network bank organisation get its external purchasing power from?] --Nad 21:51, 6 December 2007 (NZDT)

- Thanks for the info. Failover of any single or several nodes is in use with bittorrent - pieces of files ares stored in many locations so that users can reconstitute a movie independent of whether a single node is operational or not.

- We thought about this concept as well. That can solve our "what if a single node goes off the grid" issue - the financial transaction ledger can be pieced out over several computers - however it doesn't solve:

- 1) potential hacking: if the system needs to be able to reconstruct a client that "goes dark" - for instance, I shut down my computer because I owe you $100 - it must pass with it your banking information. If it was "pay to play" (you cannot distribute money without establishing a credit balance), the need for your personal bank account information is abstracted, but the concept of credits can still be hacked with the majority of security methods today: It is one thing to have a central storage system that has encrypted information talking to a client, it is quite another to have a portion of the information sitting on your desktop (if you are a hacker).

- 2) The "physical link" back to a bank - it still becomes a physical entity, and we're back to the centralized organization, once again becoming YAPP. If we YAPP with potential government regulations, why bother with the p2p - it is a bad afterthought. How many times has PayPal gone down? Never. Yes, it goes down for maintenance, but it is a highly reliable, distributed system - on par with the resiliance of any p2p network. And yet it has the added benefit of being the master "gate keeper" - it keeps your banking information safe in a single location; it decides if a transaction will go through, and in the end, they can actually resolve disputes between parties.

- So, we're back to YAPP! Argh. Does the world need another PayPal? Perhaps. But it defeats the goal of being country, currency and organization agnostic. --SC

Notes Aug 2009

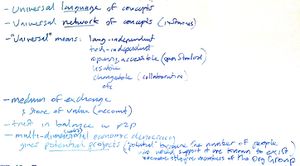

- Universal language of concepts

- Universal network of concepts (instances)

- "Universal"means:

- language independent

- technology independent

- open & accessible (open standard)

- useable

- changable (collaborative)

- etc.

- Medium of exchange & store of value (account)

- Trust in balace with p2p

- Multidimensional economic democracy gives potential projects because they're members of the organisation group

- ("potential" because the number of people who would support it are known to exist)

OpenMoney

- Thanks for The Open Money Projects, it's awesome ;-) reading all their docs now! --nad 23:01, 15 October 2010 (PDT)

- my initial reaction is that the site is a bit, er, terse. it could really use wikifying to help encourage colaboration. i found this page one of the better explanations: http://www.openmoney.org/open/proceed.html --Infomaniac 14:14, 16 October 2010 (PDT)